Table of Contents

Germany Mortgage Calculator

If you are an expat living in Germany and have been wanting to buy a house or property but have been unable to get a mortgage, don’t worry – there is help available for getting mortgage in Germany. Our partner offers a germany mortgage calculator and a variety of German mortgage support and assistance programs specifically designed for foreigners, so you can finally make your dream of owning property in Germany a reality. Keep reading to learn more about these programs and how to apply.

When considering a mortgage in Germany, it’s important to understand how certain factors such as fixed interest rates, loan amounts affect your financing options. Using a German mortgage calculator can easily help you find the right mortgage and determine what you can afford. Lenders generally review your financial data, including income, debt, and equity, to assess the risk and benefit of approving your mortgage. It’s advisable to calculate the remaining amount you need to borrow after considering down payments, fees, and other costs associated with the purchase. For example, if you’re an expat living in Germany, the details of your situation may depend on various factors. As a rule of thumb, lower interest rates mean lower monthly payments, but it’s essential to consider the long-term impact. A mortgage broker can guide you through the process and provide options based on your specific circumstances. It’s always a good idea to understand the conditions and terms of the mortgage before making a decision. By reviewing all the information in one place, such as via email or in-person, you can work towards a well-informed choice. Keep in mind that mortgages are long-term commitments, usually lasting for many years, so it’s crucial to be happy with the result. If you have any questions, don’t hesitate to get in touch.

Mortgage in Germany

The first step to getting a mortgage in Germany is understanding how the process works. In general, you will need to put down a deposit of at least 20% of the purchase price of the property, and then the bank will loan you the remaining amount. The interest rate on your loan will be determined by a number of factors, including your credit score, employment history, and the type of property you are buying.

The standard loan term in Germany is 10 years, but you may be able to negotiate a smaller monthly payment in exchange for a longer mortgage length depending on your financial situation, the loan amount and the interest rates. It is also important to note that most banks will require you to take out mortgage insurance, which will protect them in case you are unable to make your loan payments.

Mortgage Insurance

Mortgage insurance is not required by law in Germany, but most banks will require you to take out a policy before they will approve your loan. This insurance protects the bank in case you are unable to make your loan payments and default on your mortgage.

There are two main types of mortgage insurance available in Germany:

This type of insurance covers you in case you lose your job or have some other financial setback that prevents you from making your loan payments.

This type of insurance covers your mortgage payments in case you die before the loan is paid off.

The cost of the mortgage insurance will vary depending on the type of policy you choose, your age, the amount of your loan, and the length of your repayment period.

Types of German Mortgages

There are different types of mortgages available in Germany:

Variable Interest Rate Mortgage

With this type of mortgage, the interest rate on your loan will fluctuate over time in line with market rates. This can make your monthly payments higher or lower, depending on market conditions.

Fixed Interest Rate Mortgage

With a fixed-rate mortgage, the interest rate on your loan is locked in for the entire repayment period, so your monthly payments will stay the same even if market rates rise.

Interest-only mortgage

With this type of mortgage, you only have to pay the interest on your loan for a certain period of time, usually 5-10 years. After that, you will need to start paying off the principal as well.

This can be a good option if you expect your income to increase over time, as it will make your monthly payments more manageable in the short term.

Annuity Mortgage

With an annuity mortgage, your monthly payments stay the same for the entire term, but the amount of each payment that goes towards interest and principal will change over time.

At first, most of your payment will go towards paying the interest on your loan. But as time goes on, a larger portion of your payment will go towards paying off the principal.

This can be a good option if you want the stability of fixed monthly payments but want to pay off your loan more quickly.

Full Repayment Mortgage

With a full repayment mortgage, the entire amount of your loan (principal and interest) is paid back over the course of the loan term. This means that your monthly payments will be higher than with other types of mortgages, but you will pay off your loan more quickly.

This can be a good option if you have a large downpayment and want to pay off your loan as quickly as possible.

Building Society loans

In Germany, you can also apply for a loan from a building society (Bausparkasse). These are specialized banks that offer loans specifically for the purpose of buying property.

Building societies typically offer a lower interest rate than regular banks, but they may require you to take out additional insurance policies or make a higher downpayment.

How You Can Buy a Property with a House Loan in Germany

If you are a foreigner looking to buy a property in Germany, there are a few things you need to know about the process.

Step 1

- You will need to have a valid residence permit that allows you to live and work in Germany.

- You will also need to have a good credit history and earn enough income to make the monthly loan payments. Once you have all of the necessary documentation in order, you can start searching for a house/apartment.

- It is a good idea to use a real estate agent to help you find a something suitable and negotiate the purchase price.

- Use the German Mortgage Calculator above to calculate your german mortgage and the mortgage rate for your financial situation

Step 2

- Once you have found a property you want to buy, and agreed on the purchase price the next step is to apply for a mortgage to calculate your monthly payment.

- The application process will vary depending on the bank or lender you are working with, but you will typically need to provide some documentation, including your passport, proof of income, and proof of employment.

- Dont forget to also consider the real estate agent fees which can range up to 7% of the purchase price.

- We strongly recommend you to take a fixed interested rate mortgage deal to be able to comfortably plan your monthly payments.

Step 3

- After your mortgage application has been approved, the bank will send a valuation of the property to make sure that it is worth the purchase price.

- Once the valuation has been approved, the bank will transfer the loan amount to your account and you can start the process of buying.

How we will assist you in this process

As your personal mortgage broker, we will be with you every step of the way, from finding the best mortgage deal that suits your needs to help you with the paperwork and application process. We have a wide network of lenders and banks that we work with, so we can find the best mortgage rate for you.

We understand that buying a property can be a stressful experience, so we will make sure that the process is as smooth and hassle-free as possible.

German Mortgage Calculator

Mortgage Calculator – Ready to purchase a property in Germany?

Have Carita and Paul find the best mortgage offer for you!

Answer 10 questions, get your pre-approval financing certificate!

100% free to you €0

Loan Calculator Germany

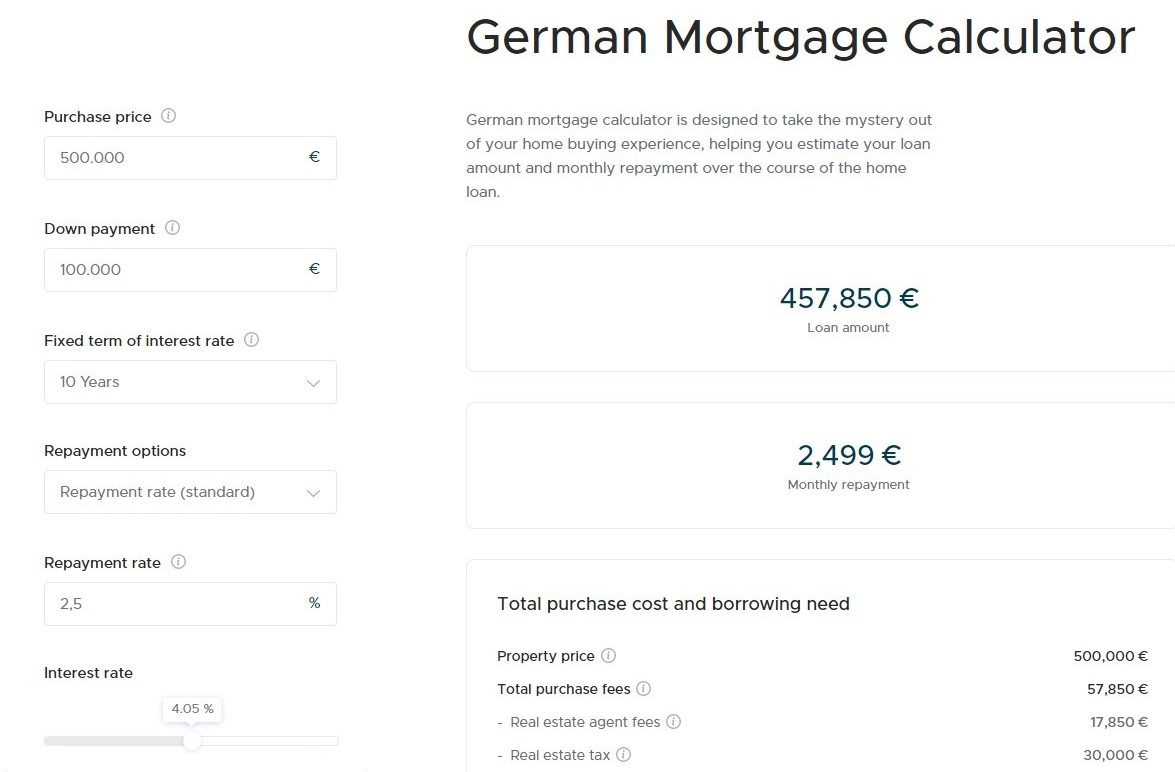

When you are looking to buy a property in Germany, it is important to calculate how much you can afford to borrow. With our mortgage calculator, you can easily see how much your monthly payments would be and how much interest you would pay over the course of the loan.

How the home loan calculator works

To calculate your monthly payments, enter the mortgage amount, monthly repayment, and interest rate into the calculator. The calculator will then give you an estimate of the monthly payments and total interest payable.

The mortgage calculator is a great tool to help you budget for your new home purchase. It can also help you compare different loan options to find the best one for you.

Does a mortgage calculator guarantee that you’d receive a mortgage?

A mortgage calculator is a helpful tool, but it is important to remember that it is only an estimate. The actual amount and the interest rate you receive will depend on many factors, including your credit history, income, and employment status.

How does a German Mortgage Calculator Work

The amount of the monthly mortgage payment, the interest rate, the length of the loan, and any other fees or charges are calculated using intricate mathematical computations by a German mortgage calculator.

Requirements to Apply for German Mortage

You’ll need to gather several documents, many of which will be from several years ago, to verify that you fulfill the above requirements for your mortgage application. We can help you figure out which papers you’ll require. This usually includes:

- A form of ID (e.g. passport)

- Residence permit (if applicable)

- Registration certificate

- Proof of a German pension scheme, (e.g. social security ID)

- Proof of available equity

- Documents related to the property, (e.g. land registry extract, property assessment )

Steps Involved in a German Mortgage Process

Now that you know what you’ll need and what to expect, let’s walk through the key steps of getting a mortgage in Germany.

This step involves shopping around for the best interest rate and terms that suit your needs. It’s important to compare different offers from a range of lenders, as they can differ significantly. We’ll help you compare fixed interest rate and variable from different banks and lenders to calculate your monthly payment.

In this step, you’ll need to gather all of the required documents for your mortgage application. This can include your passport, proof of income, bank statements, and more. We can help you figure out which documents you’ll need.

This step involves filling out a mortgage application and submitting it to the lender. The application will ask for information about your finances, employment, property and bank account. We’ll help you fill out the application and submit it to the bank or lender to get the best mortgage deal.

In this step, the bank will send a valuation of the property to make sure that it is worth the purchase price.

Once the valuation has been approved, the bank will transfer the mortgage amount to your account and you can start the process of buying.

Process of Buying Property in Germany

Thinking about buying a home? We help you buying a property in Germany, we asked an expert to come up with this Guide to clearly outline what you can expect at every single step of you going through the property buying process. If you are looking for your dream house for your family or are an investor looking into the German real estate market, the steps described in this guide will help you navigate through the process.

Mortgage Calculator Germany will help you find out the monthly mortgage payment. Also, easily input a different home price, down payment, loan term and interest rate to see how your monthly payment will change. These Estimates are broken down by principal, interest, property taxes and homeowners insurance.

Mortgage & Property Buying Process

- Check your affordability online

- Chat with our mortgage advisor

- Finding the right property you afford

- Secure and reserving the property

- Finalizing your mortgage contracts

The most important things to consider are:

- How long term do you want to fix the interest period?

- How quickly and easy do you want to pay back your mortgage?

- Equity you put to get the best rate?

- You have full access to your new property.

Only after the vendor has received the complete amount of the acquisition amount on their checking account, you’ll arrange for the official handover of your new property.

Frequently Asked Questions

Yes, foreigners can apply for a mortgage in Germany. However, there are some additional requirements that you’ll need to meet, such as having a residence permit and proof of income.

No, buying a property in Germany does not automatically qualify you for a residency visa. However, if you can show that you have a stable income and are able to support yourself, you may be eligible for a residency visa.

Yes, EU citizens can buy property in Germany. However, they may need to obtain a residence permit and proof of income in order to qualify for a mortgage.

German mortgage rates can vary depending on the type of loan and the lender. However, interest rates are typically around 3-4% for fixed-rate loans and 2-3% for variable-rate loans.

My Mortgage Germany UG is a certified mortgage intermediary according to §34i Abs 1, S. 1 GewO supervised by the Berlin Gewerbeamt.

Friedrichstr. 123 | 10117 Berlin | Germany

©2023 All Rights Reserved. MyMortgageGermany.de